One of the main rules of responsible consumer behavior is spending within your means. When your expenses are within the budget, it doesn’t disturb your finances too much, it doesn’t get you into debt, and it doesn’t create a deficit. Moreover, it creates space for savings, investments, and financial security.

On the other side, there’s a deficit, that is, spending outside of your budget. That can be a tolerable tactic for a short period until you get back on track with your finances. But don’t make it a sustainable solution, as over-indebtedness is an area where you certainly do not want to be.

Governments generally operate with a deficit, that is, their revenues are not enough to cover current expenses, and that balance usually increases from year to year. You can find out more about it at this link. However, state governments have their mechanisms to solve this problem and still do well. Here, we focus on the individuals who may be in trouble because they’re in a deficit.

Create a Budget and Stick to It

Spending money without a plan is almost a sure path to overspending and over-indebtedness. When you make purchases randomly and pay bills without previous records, you can face many problems. Unfortunately, that can hit you hard when you look at your bank statement at the end of the month.

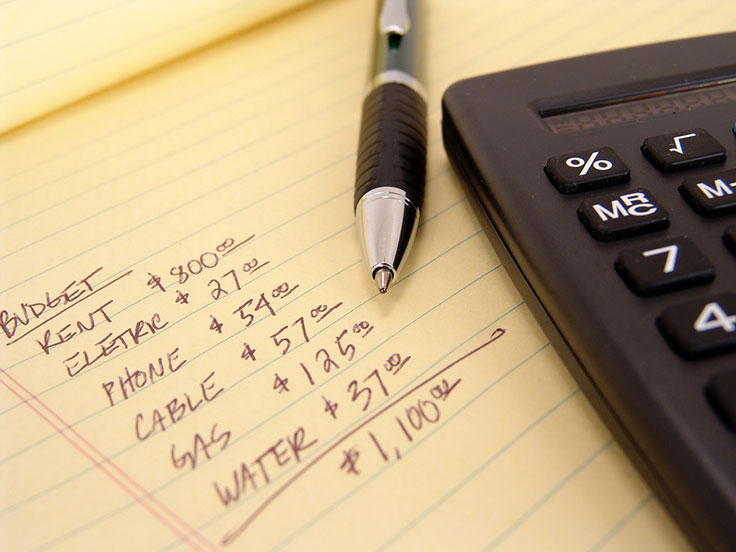

To avoid a deficit at the end of each month, the best thing you can do is make a plan and stick to it. Put all income and expenses on paper (or in a phone app). Determine what the priorities are and settle them first. These are utilities, high-interest debts like credit card balances, and installments for short-term loans.

Don’t fall behind your financial obligations, even if you’ll have very little money left for other needs. Rolling a card balance or skipping loan repayment adds up interest on your debt and increases it further. It may be hard for you to give up new shoes because you need to pay off the card balance. But you’ll realize that was a good move when you end the month without unnecessary debts.

If you stick to the spending plan for a while, you will see results very soon. After cutting the share of debt in your budget, there are many possibilities to make the best use of surplus money. Of course, it’s best to save, invest, or make extra payments to get rid of some debt faster, but it won’t hurt to treat yourself from time to time.

Find Another Source of Income

You can reduce the share of debt in your budget by paying it off or increasing your income. It would be best if you could do both at the same time because the process of overcoming the deficit would be twice as fast. However, as that’s not always possible, try one of these methods first.

Finding an additional source of income will bring extra money into your wallet. If you use it wisely to solve current financial issues and pay off high-interest debts, you will get out of this trouble quickly. This additional income is a much better option than getting a loan because it helps you solve your problems without adding up to your current debt.

An extra source of income can be a part-time job, freelancing, selling things you don’t need, or monetizing a skill you possess. Then, try to find a better-paying job or get a raise at your current work. Finally, dare to start your own business that doesn’t require too much funds and can bring good passive income, like dropshipping or an online store.

Refrain from Impulsive Purchases

The holiday season is around the corner, and with it comes a considerable stretch of your budget. Of course, you want to spend this period of the year with your loved ones, enjoying your favorite food and drinks, or on a well-deserved vacation. And while you can’t (and shouldn’t) avoid some expenses, the holiday season is when impulse buying is prevalent, and that certainly leads to overspending and budget deficits.

It’s hard to resist when you’re lured from all sides by glitzy storefronts, “unbelievable deals,” and pompous sales. The holiday spirit often misleads you not to perceive these as marketing gimmicks, which they usually are. Instead, you’d think you grabbed some really good deals while shopping for Christmas decorations or gifts for your loved ones.

It can be easier said than done to get rid of reckless spending. But before you swipe your card, ask yourself a critical question – do you really need what you want to buy? If it’s something you can live and spend days without, postpone the purchase for a while. Once your finances heal, you’ll be able to afford it without going into debt.

Track Your Spending

If you don’t know where your money is going, there is a greater chance that you’ll spend more than you really need. You have to stay on top of your spending by knowing your expenses. You can list them within your budget, and you can split them into mandatory payments (utilities, loan repayment, grocery shopping) and non-essential ones

And while there is a way to manage mandatory expenses, for example, by making a shopping list, pay more attention to these others. Track them from month to month, and you can already notice the money-spending pattern.

See which unnecessary costs you can waive and which you can reduce. These can be small things, like canceling a subscription to an online magazine or changing a gym for another one two blocks away with a cheaper membership fee.

Invest

When you spend more than you earn, instead of saving, the only thing that can go up is debt. The longer you’re in a deficit, the bigger your debt and the worse your finances will be. Eventually, you may get into a situation when the only salvation will be taking a loan for debt consolidation. It might help, but it’s not always the best solution because these loans can be quite expensive.

The lifeline can be investing, but not at the cost of putting an additional burden on your budget. It should be done only when you relieve your finances a bit, but you shouldn’t expect a miracle. Investing is not a short-term strategy that’ll magically waive your expenses and debts and turn your deficit into a surplus.

Instead, it takes time for good decisions to bring profit that can help you manage debt and overcome the deficit in your budget. Investing requires thorough thinking, research, decision-making, and, above all, patience.

With so many assets on the market, you can create a solid portfolio in which there should be room for precious metals. For such investments, the help of reputable investing companies like Goldco will come in handy. They can give you a hand on which investment might suit your goals and financial capability and guide you in the process.

Getting into deficit spending can get you in the vicious circle of over-indebtedness. It can go all the way long and ruin your finances and credit report for good. So it’s about time to step aside against overspending and create better financial habits.